8 Free Online Calculators That Simplify Financial Planning

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

The internet can be a powerful source of information, particularly when it comes to understanding financial transactions. Gone are the days when brokers or lenders were the only ones who could compute your loan interest. With a quick online search, now everyone has the ability to pull up a free financial calculator to do the heavy lifting. Even somewhat difficult computations like mortgage interest can be performed with just a few keystrokes.

Here’s a look at eight specialized types of online financial calculators that you can use for specific financial computations, along with an explanation of how you can build your own calculator for your particular needs. If you just need some simple help and aren’t looking to build a comprehensive financial plan, these calculators can help get you started:

- Mortgage Payment Calculator

- Loan Payment Calculator

- Retirement/401(k) Plan Savings Calculator

- Auto Loan Calculator

- College Savings Calculator

- Net Worth Calculator

- Debt Planning Calculator

- Tax Return Calculator

- How To Build Your Own Financial Calculator

Mortgage Payment Calculator

When calculating a mortgage payment, you’ll have to factor in a down payment, mortgage insurance, property taxes, homeowners insurance and other fees in addition to the price of your home and the interest rate on the loan. The Zillow mortgage calculator offers a sleek interface that allows you to input all of the variables of your mortgage loan to compute a single monthly payment amount.

Pros: Has a wide range of reports and graphics to highlight user inputsCons: Loan options that are usable in the calculator are limited to 30-year fixed, 15-year fixed and 5/1 adjustable-rate mortgages

Find Out: How To Make a Mortgage Payment

Loan Payment Calculator

A generic loan payment calculator is probably the simplest and most wide-reaching type of financial calculator. You can use a generic loan calculator for personal loans, credit cards or any other type of simple loan. This example from Merrill Edge asks for your loan amount, payment frequency, stated interest rate and term length to calculate your monthly payment. You can also add in additional costs, such as origination fees, if applicable.

Pros: Simple to use for nearly any type of loanCons: Doesn’t allow for detailed inputs

Check Out: 10 Best Personal Loans for People With Good Credit

Retirement/401(k) Plan Savings Calculator

A retirement/401(k) plan savings calculator can show you in black and white how the power of compounding works. As such, it can be one of the more exciting tools available. By inputting a regular monthly contribution amount and an expected rate of return, you can estimate how much money you’ll have socked away by the time you retire.

The AARP retirement calculator allows you to input multiple variables for various retirement planning scenarios, incorporating everything from current and future savings to estimated Social Security and supplemental income benefits in the future.

Pros: Incorporates many retirement planning variablesCons: Doesn’t allow for detailed lifestyle- or investment-related inputs

Also See: Here Are 30 Ways To Retire Earlier

Auto Loan Calculator

An auto loan calculator is an essential tool when you are financing a vehicle, as you can tinker with various terms and down payments to see how they will affect your monthly cost. A good auto loan calculator, like the one at Cars.com, will factor in the cost of the vehicle, your down payment, your trade-in value (if any), the interest rate, your sales tax rate and your term to calculate your monthly payment.

Pros: Simple to use but still includes all important variablesCons: Doesn’t pre-fill sales tax rate

Be Aware: Top 8 Hidden Costs of Taking Out an Auto Loan

College Savings Calculator

Although you can use a basic financial calculator to see how your college savings can grow, a specialized one, like the one offered by 529 plan aggregator Savingforcollege.com, allows for specific college-related inputs. In this calculator, you can enter your child’s age, the type of college your child is aiming for and your household income.

In addition to showing you how much you need to save to reach your college funding goals, the calculator can estimate the total amount in scholarships and grants your family might be eligible for, based on your income. You can tweak the amount of your potential monthly contribution to see how it will affect your final balance.

Pros: Generates colorful, personalized reports based on user inputs, and estimates how much financial assistance your family might receiveCons: You may see an ad or two pop up when first arriving

Discover: What It Costs To Attend the 25 Most Beautiful Colleges in America

Net Worth Calculator

Your net worth is an important indicator of how financially secure you are. The basic formula for net worth is assets minus liabilities. However, a good net worth calculator, like the one from CalcXML, will itemize all of your assets and liabilities in a detailed fashion.

Seeing your net worth grow regularly via the use of a good calculator can help incentivize you to continue — or incorporate — sound financial habits. If you have a negative net worth, a good calculator can help you see what you need to do to improve your financial standing.

Pros: Provides a wide range of general categories to help compute net worthCons: Doesn’t drill down deeply into each category

Learn: How To Calculate Your Net Worth

Debt Planning Calculator

A good debt planning calculator, like the Financial Mentor debt payoff calculator, can help you plan the best way to attack your existing debt. It can also show you the damage done by high-interest credit card debt.

With the Financial Mentor debt calculator, you enter the balance you owe, the interest rate you’re paying and your desired date to be debt-free. The calculator will then show you the monthly payment you’ll need to pay off your debt, the number of payments you’ll have to make, and how much interest you’ll pay along the way.

Pros: Simple, direct way to calculate debt and see a payoff planCons: Numerous enticements to apply for loans on the page around the calculator itself

Strategize: How To Get Out of Debt — A Step-by-Step Guide

Tax Return Calculator

For many Americans, tax returns are a bit of a mystery. In fact, for tax year 2016, the most recent year for which data is available, the IRS reported that 53.5% of returns were filed by paid preparers. If you need help getting a handle on where you stand, there are plenty of online tax return calculators that can estimate your taxes for you.

The free income tax calculator by H&R Block is a fairly thorough example, requiring you to enter your filing status, income from all sources and deductions, among other inputs. A few quick keystrokes later, the calculator will spit out your estimated tax liability. This calculator is particularly helpful for self-employed workers, as it includes the computation for self-employment tax.

Pros: Provides a good overview of your tax situation, and includes self-employment taxCons: If you don’t already know how to do your own taxes, you might input some of your variables incorrectly

Related: Here’s the Average IRS Tax Refund Amount

How To Build Your Own Financial Calculator

If you can’t find the right free online calculator to use for your particular needs, or if you want to use a specialty calculator, you can always build your own — and there are plenty of options to help you out.

Spreadsheet applications like Microsoft Excel and Google Sheets make it easy to develop any computations that you would like, from simple calculations to complex formulas. For example, if you need to add up different inputs in Excel, list them in a column, then simply select a cell at the bottom and click the AutoSum button, and the spreadsheet will enter the formula for you automatically.

7 Steps To Create a Budget Calculator

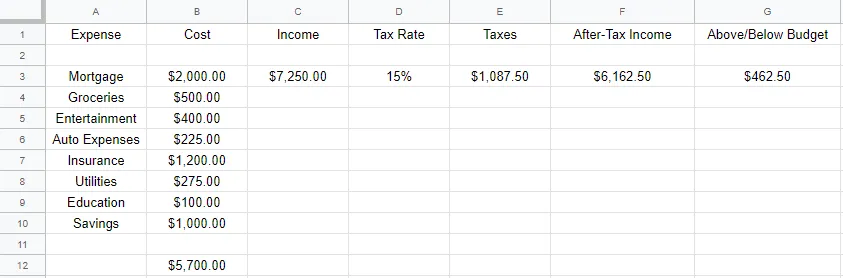

To build a generic calculator in a spreadsheet, simply list your inputs and insert appropriate formulas. For example, to create a simple budget calculator, follow these steps:

- In the first column, list the categories of all of your expenses, such as mortgage and groceries.

- In the second column, enter the amount of your monthly expense in that category. Sum those expenses at the bottom of the column.

- In the third column, enter your monthly income.

- In the fourth column, enter your average tax rate. You can calculate this rate from your prior year’s tax return; simply take your total taxes paid and divide it by your gross income.

- In column five, multiply your gross income by your tax rate. This is your total tax obligation.

- In column six, subtract column five from column three. This is your net after-tax income.

- In column seven, subtract the summation at the bottom of column two — your total expenses — from column six, your net after-tax income. This will show whether you are spending above your budget or if you have excess income left over.

Pros: Gives you the freedom to modify your calculator as you see fitCons: Requires you to understand what you’re trying to solve for

Keep reading to learn how to create your own financial plan in eight steps.

More From GOBankingRates:

Written by

Written by